It’s 2024 and there’s a lot for Colorado business owners to navigate when it comes to legal updates. One of the biggest updates for this year involves a significant legislative development that directly impacts the landscape for Colorado businesses—the Corporate Transparency Act (CTA). This comprehensive guide is tailored to help you understand the intricacies of the CTA and its implications for your business.

Unveiling the Corporate Transparency Act

In the dynamic world of business, understanding and complying with evolving regulations is paramount. The CTA’s mission is to unveil the true identity of key players in a business and to enhance transparency and accountability in corporate structures. The federal Corporate Transparency Act went into effect on January 1, 2024 and applies to all businesses in the United States. It is overseen by the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN).

The Legislative Objective

Enacted to combat financial misconduct and illicit activities, the CTA seeks to unmask the real identities behind corporate entities. By requiring businesses to disclose their beneficial owners, the government aims to fortify oversight, ensuring fairness and ethical conduct within the business ecosystem.

How Does the CTA Impact YOU as a Business Owner?

The best way for a business owner to look at the CTA is to consider it as another reporting requirement for your business. While at first it may seem overwhelming, these new reporting requirements are consistent those of other nations and requires information that business owners must already have on hand when forming a business.

Who Needs to Comply?

The CTA applies to a broad spectrum of businesses, including corporations, limited liability companies (LLCs), and other similar entities. Generally, entities formed under state law that are not subject to specific reporting requirements already fall within the purview of the CTA.

Why Do Business Owner’s Need to Report? Transparency in Ownership

The CTA mandates a departure from opaque ownership structures. Previously, some businesses could shield their true ownership, but the CTA demands clarity. This requirement not only fosters transparency but also acts as a deterrent to potential fraudulent activities. The CTA focuses on identifying and disclosing the real, “beneficial” owners behind corporate entities. Beneficial owners are individuals who directly or indirectly control a significant portion of the company, making decisions and influencing its operations.

Is Reporting Onerous? Enhanced Reporting Obligations

Initiating a small business is comparable to joining a legal framework, and the CTA introduces more comprehensive reporting requirements. When establishing your business, you must provide detailed information about the actual individuals in control. Think of it as formally introducing the legal team behind your business to the regulatory authorities.

What Information Do Business Owners Need to Provide?

Businesses subject to the CTA must submit a report to the Financial Crimes Enforcement Network (FinCEN). The report must include the following information:

- The full legal name of the reporting company.

- The address of the reporting company’s primary place of business.

- The jurisdiction under which the reporting company is organized.

- The date of the company’s formation or registration.

- A unique identifier assigned to the company by FinCEN.

For each beneficial owner, the report must include:

- Full legal name.

- Date of birth.

- Current residential or business address.

- Unique identifying number from a current U.S. driver’s license, U.S. passport, or identification document issued by a State, including a U.S. territories, commonwealth, or possession, local government, or Indian tribe.

- Photocopy of the referenced identification document.

The identification document used in a BOI report may not be expired. If none of the identification documents listed above exist, an unexpired foreign passport may be used.

What Constitutes a Beneficial Owner?

A beneficial owner, according to the CTA, is an individual who:

- Exercises substantial control over the company.

- Owns or controls at least 25% of the ownership interests.

- Receives substantial economic benefits from the assets of the company.

Identifying and verifying beneficial owners is a critical step in meeting CTA requirements.

Are There Any Exemptions or Exceptions?

Certain entities and individuals may be exempt from CTA reporting requirements. Exemptions include publicly traded companies, entities already subject to stringent reporting obligations, and certain government entities.

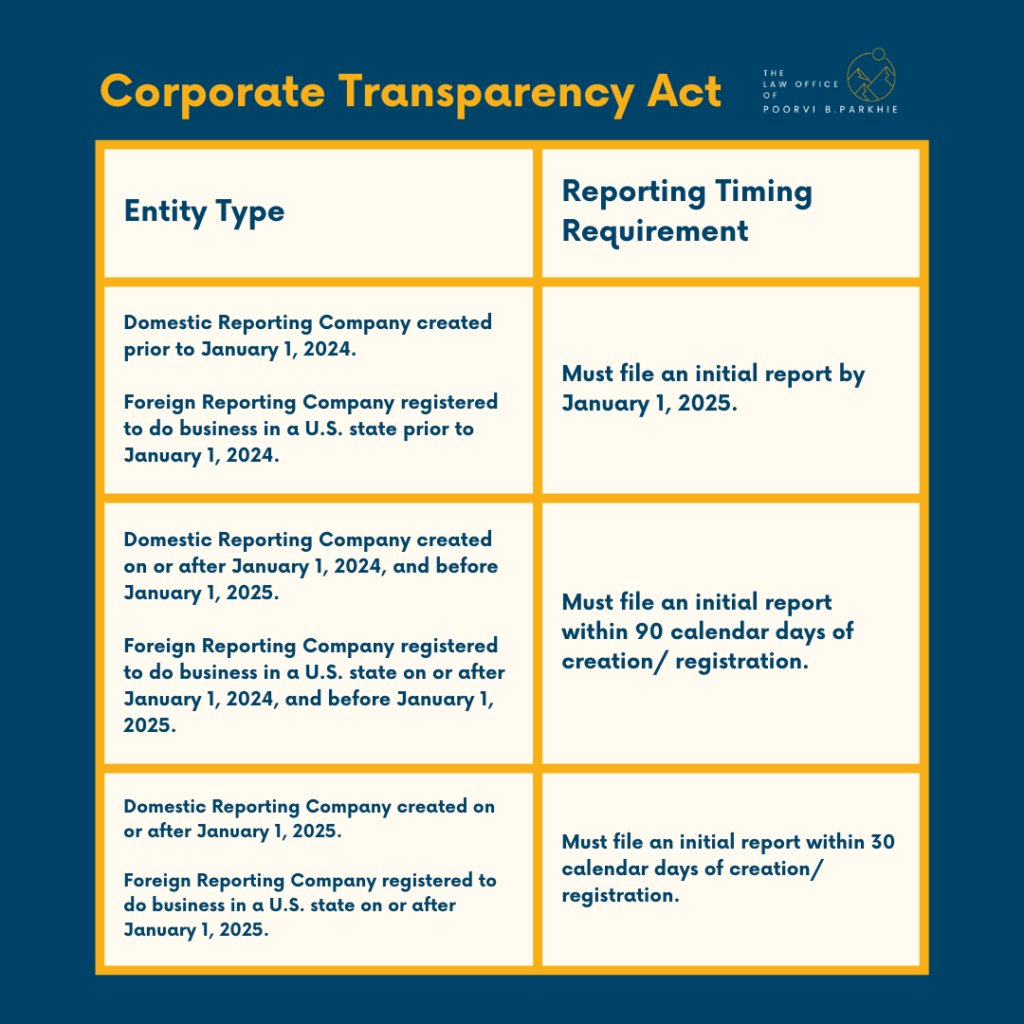

When Do Business Owners Need to Report By?

The reporting timeline is essential for compliance.

- Entities formed prior to January 1, 2024 will have the 12 months of calendar year 2024 to register, with a reporting deadline of on or before December 31, 2024.

- Entities formed during calendar year 2024, from January 1, 2024 to December 31, 2024, have ninety (90) days to register.

- Entities formed on or after January 1, 2025 will have thirty (30) days to register.

Are There Penalties for Non-Compliance?

Failure to comply with CTA requirements can result in severe penalties. Civil penalties may be imposed for willful violations, and individuals intentionally providing false or misleading information may face financial penalties of up to $500 per day and criminal penalities, which includes jail time.

Are There Ongoing Obligations?

Businesses must keep records of the information provided in their reports for five years after the date of submission. These records should be made available to FinCEN, law enforcement agencies, and other authorized entities upon request.

Is It Easy to Submit? Streamlined Documentation Process

While the CTA adds a layer of documentation, akin to legal profiles for superheroes, rest assured that the process is manageable. It ensures that the government possesses the necessary information to maintain regulatory integrity without overwhelming small business owners.

How Secure is the System? Privacy and Safeguards

Recognizing the need for confidentiality, the CTA safeguards sensitive business information. It strikes a balance between regulatory transparency and protecting the proprietary aspects of your business, similar to the privacy measures superheroes employ to protect their true identities.

Who does the CTA Benefit? Fostering a Level Playing Field

In the business arena, fairness is paramount. The CTA eliminates any potential advantages that might have existed for businesses with concealed ownership structures. It promotes an equitable business environment, aligning with the principles of justice upheld by the legal system. The CTA also aims to make it more difficult for criminal organizations to use complex business structures to hide fraudulent activities. Gone are the days of not knowing the person/people behind a complex business.

The Corporate Transparency Act represents a pivotal step towards fortifying the legal framework governing businesses. If you want more information about the CTA, you can access FinCEN’s current Entity Compliance Guide online at: https://www.fincen.gov/boi/small-entity-compliance-guide.

As a law firm dedicated to serving our clients, we recognize the importance of adapting to regulatory changes. Embracing the CTA ensures that your business not only complies with the law but also contributes to the creation of a more transparent and equitable business environment. Give us a call if you need further guidance on navigating the intricacies of the Corporate Transparency Act!

Disclaimer: This is not legal advice and should not be relied on as legal advice. This content is for educational and informational purposes only.